Contributions of Lunch-Check do not form part of the salary. Up to an amount of 180 francs per month and employee (updated 1.1.2010), any contribution to the cost of meals of this kind does not have to be declared as salary. Contributions of Lunch-Check nevertheless appear on the salary statement. As do contributions of Lunch-Check over 180 francs, with and without the employer’s share.

Depending on how high the employer contribution is, contributions of Lunch-Check are to be declared as follows:

Example 1:

Lunch-Check up to CHF 180 per month issued free of charge.

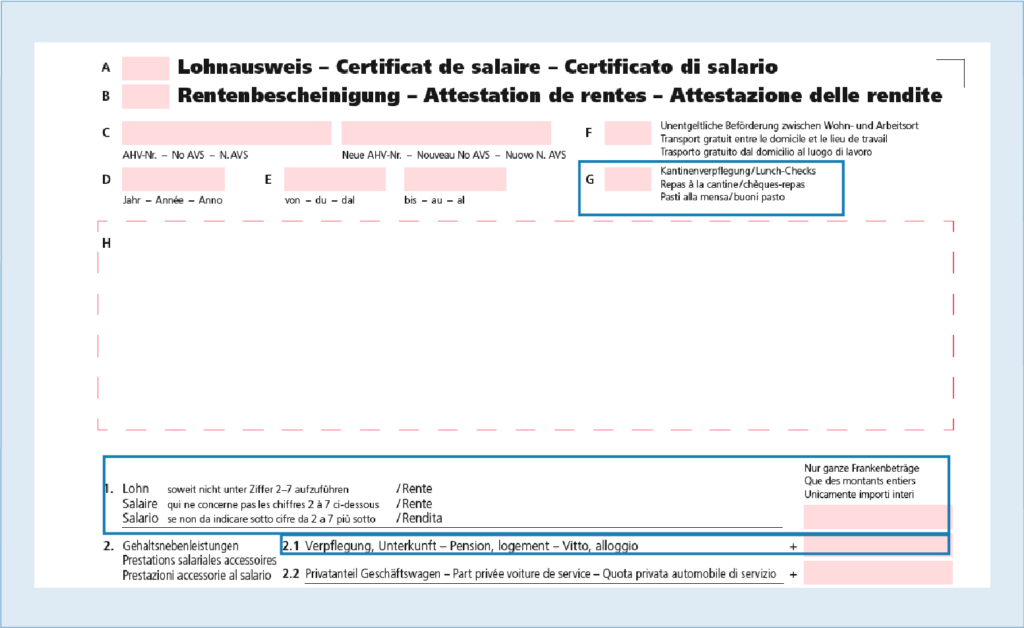

The amount of CHF 180 is not exceeded. Only field G (canteen meals / Lunch-Checks) must be crossed.

Example 2:

Lunch-Check issued in the amount of CHF 300 per month at half price (i.e. the employee pays CHF 150).

The employer contribution of CHF 180 is not exceeded. Only field G (canteen meals / Lunch-Checks) must be crossed.

Example 3:

Lunch-Check issued in the amount of CHF 240 per month free of charge.

Disclose difference of CHF 60 (CHF 720 p.a.) as taxable amount (item 2.1) and place a cross in field G (canteen meals / Lunch-Checks).